What is ANEXT Bank?

ANEXT Bank is a Monetary Authority of Singapore (MAS) Regulated SME Digital Bank providing innovative and secure digital financial services to local and regional micro, small and medium enterprises (SMEs) to aid their growth and global expansion.

Through continuous technology-driven innovation, ANEXT Bank is dedicated to accelerating fintech development and financial inclusion in Singapore and the region.

What is the benefit of getting a loan through Shopmatic?

When you apply for a loan through Shopmatic, your loan processing fee will be waived by ANEXT Bank. The usual processing fee by ANEXT Bank is 1% of the loan or S$200 whichever is higher will be saved.

What is the maximum loan amount that I can apply?

You can apply for an ANEXT Business Loan of up to S$300,000.

Who can apply for the ANEXT term loan?

Currently, Shopmatic Pay enabled merchants in Singapore can enable this feature.

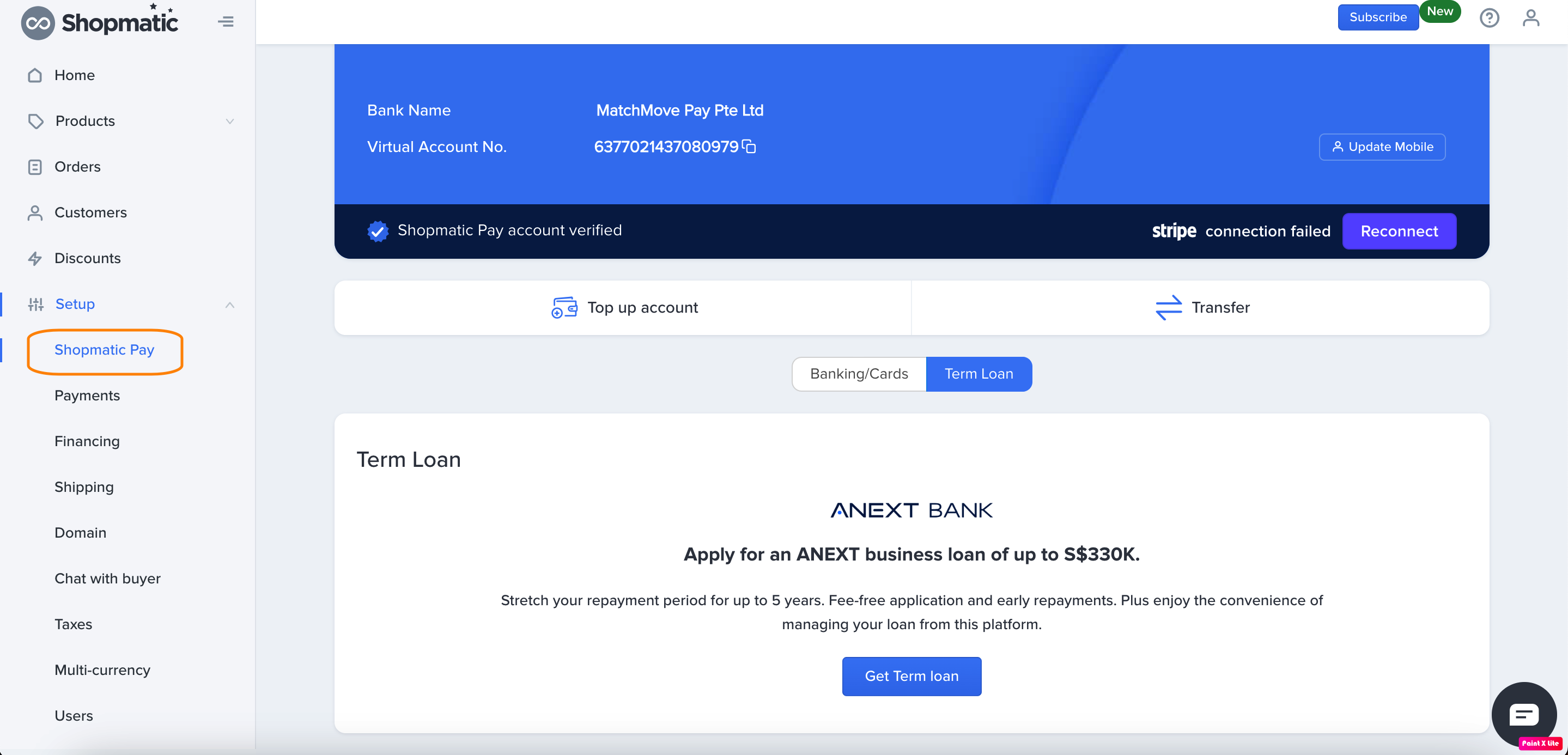

How to access the ANEXT loan application form?

You can access the ANEXT term loan application in two ways:

- Click on Setup > then Financing option > and then click on the “Get Term Loan” button.

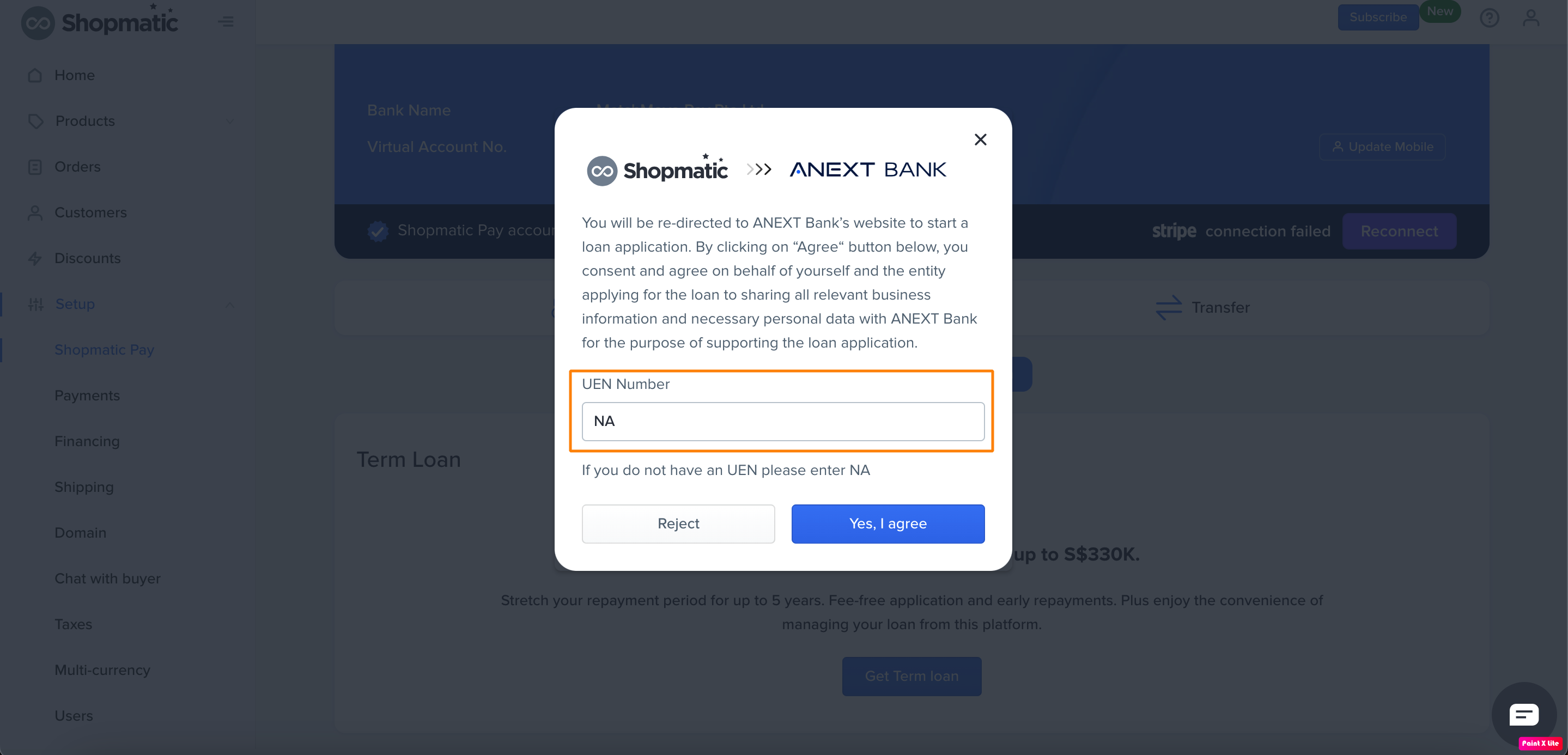

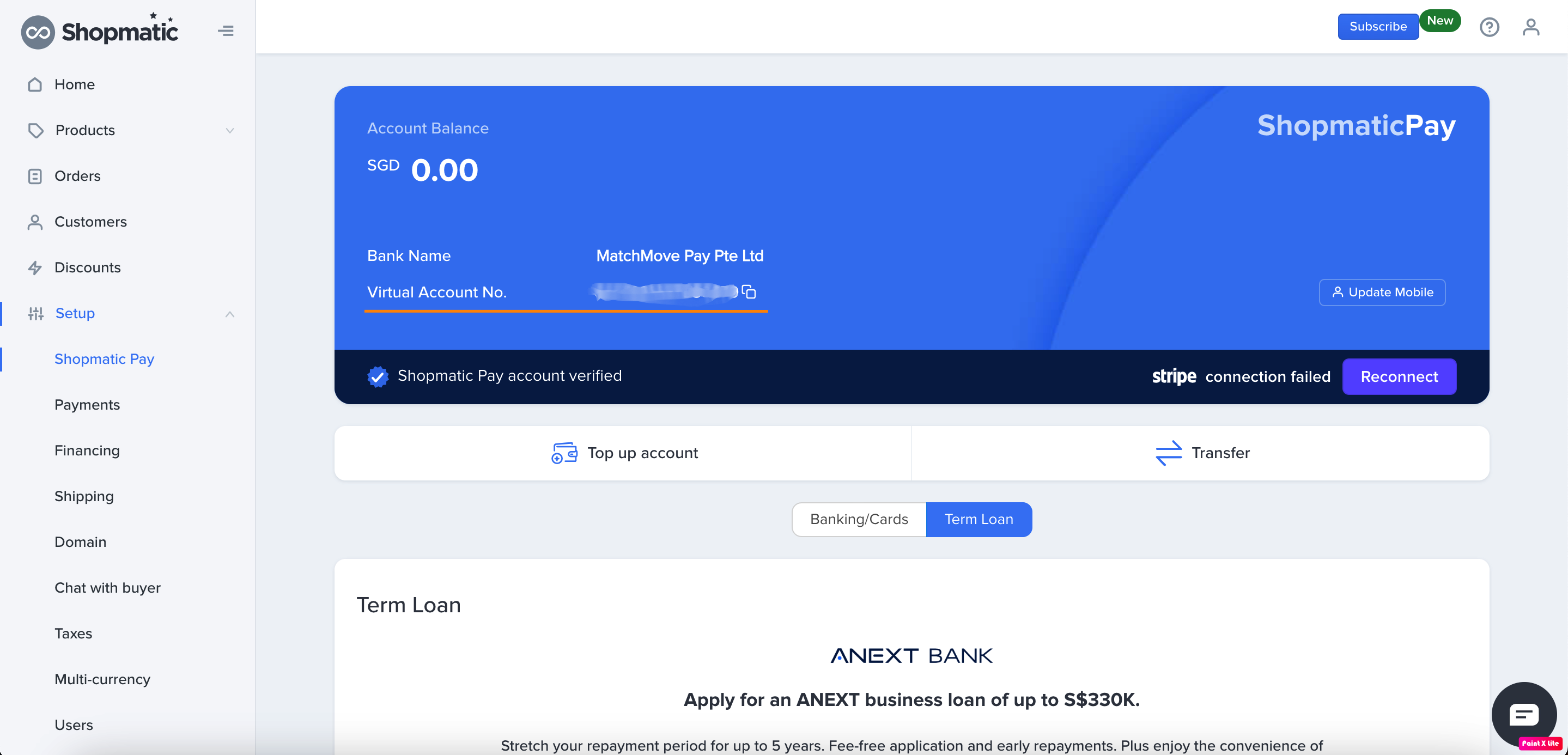

- Click on Setup > then click Shopmatic Pay option > Under the Term Loan tab, click on the “Get Term Loan” button.

How can I apply for a term loan application?

You can apply for a term loan, only when you enable Shopmatic Pay in Singapore.

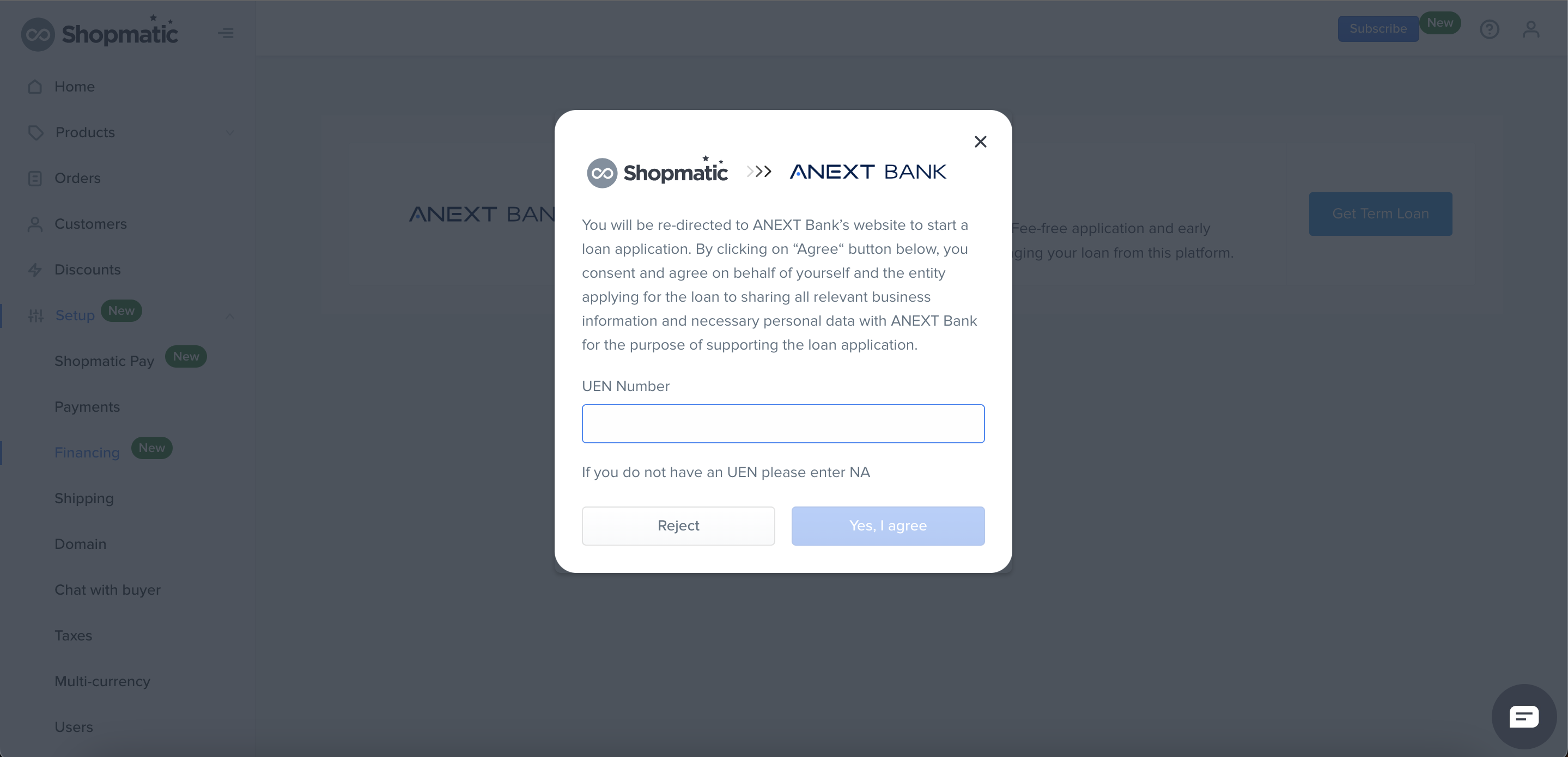

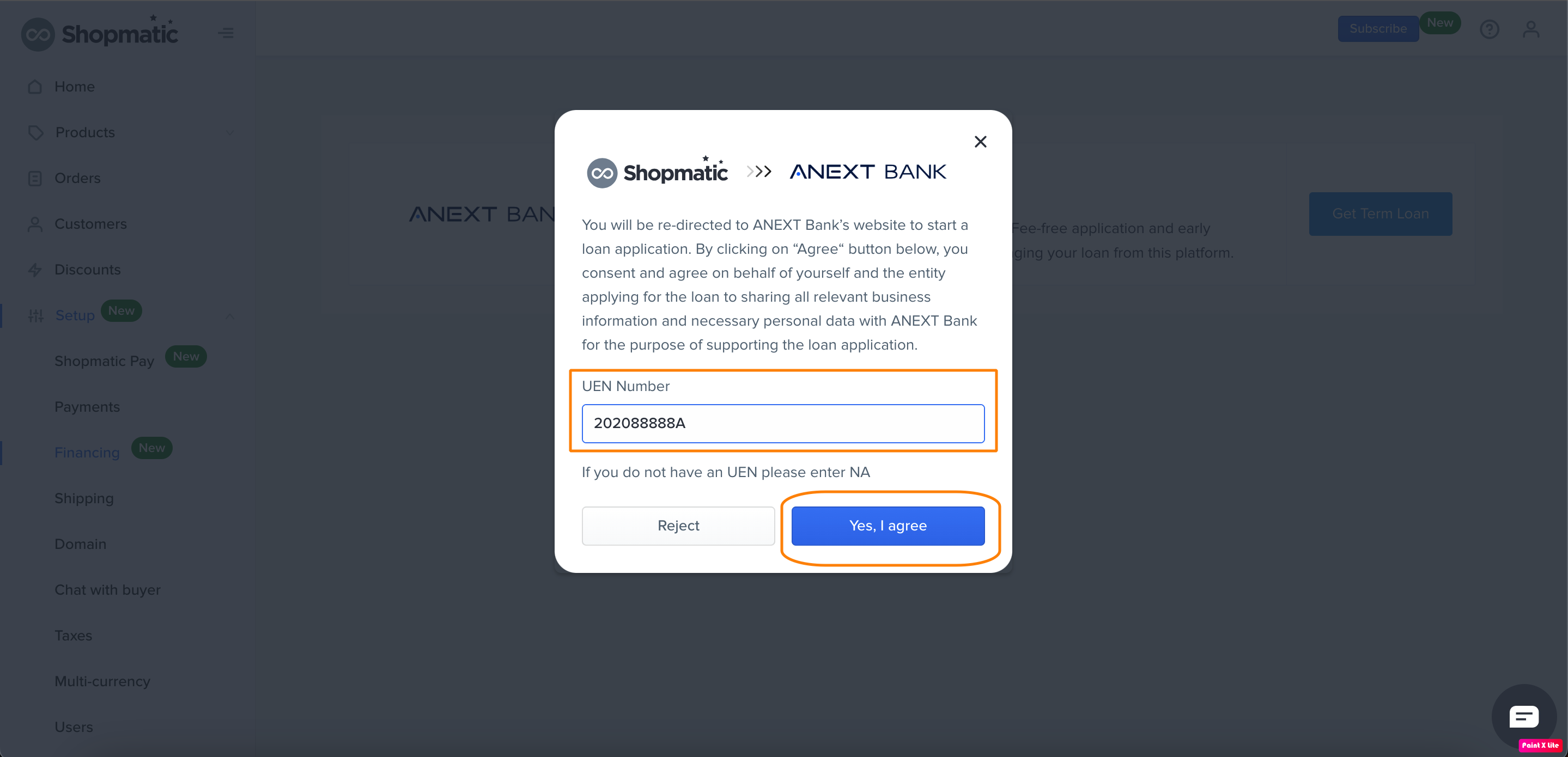

Clicking on the “Get Term Loan” button, will open the pop-up with UEN field. After agreeing to the consent, you will be redirected ANEXT loan application page.

What can I enter in the UEN field?

Unique Entity Number (UEN) is a 9 or 10 digit identification number that is issued by the government in Singapore to all entities that operate within the country.

The UEN field can not be kept empty. We accept 9-10 digit values as UEN or NA in case you do not have UEN.

Can I apply for a term loan without UEN?

Yes, you can apply for a term loan, provided you submit the loan application form successfully.

What if I do not accept the consent and apply for a term loan?

This consent is to share the basic information required for processing the term loan. If you do not accept the consent Shopmatic will not be able to proceed further with your loan application.

How can I apply for a term loan?

Term loan can be applied from two places, Financing Tab as well as from ShopmaticPay. ShopmaticPay is mandatory to process your term loan application.

What happens once you submit the loan application?

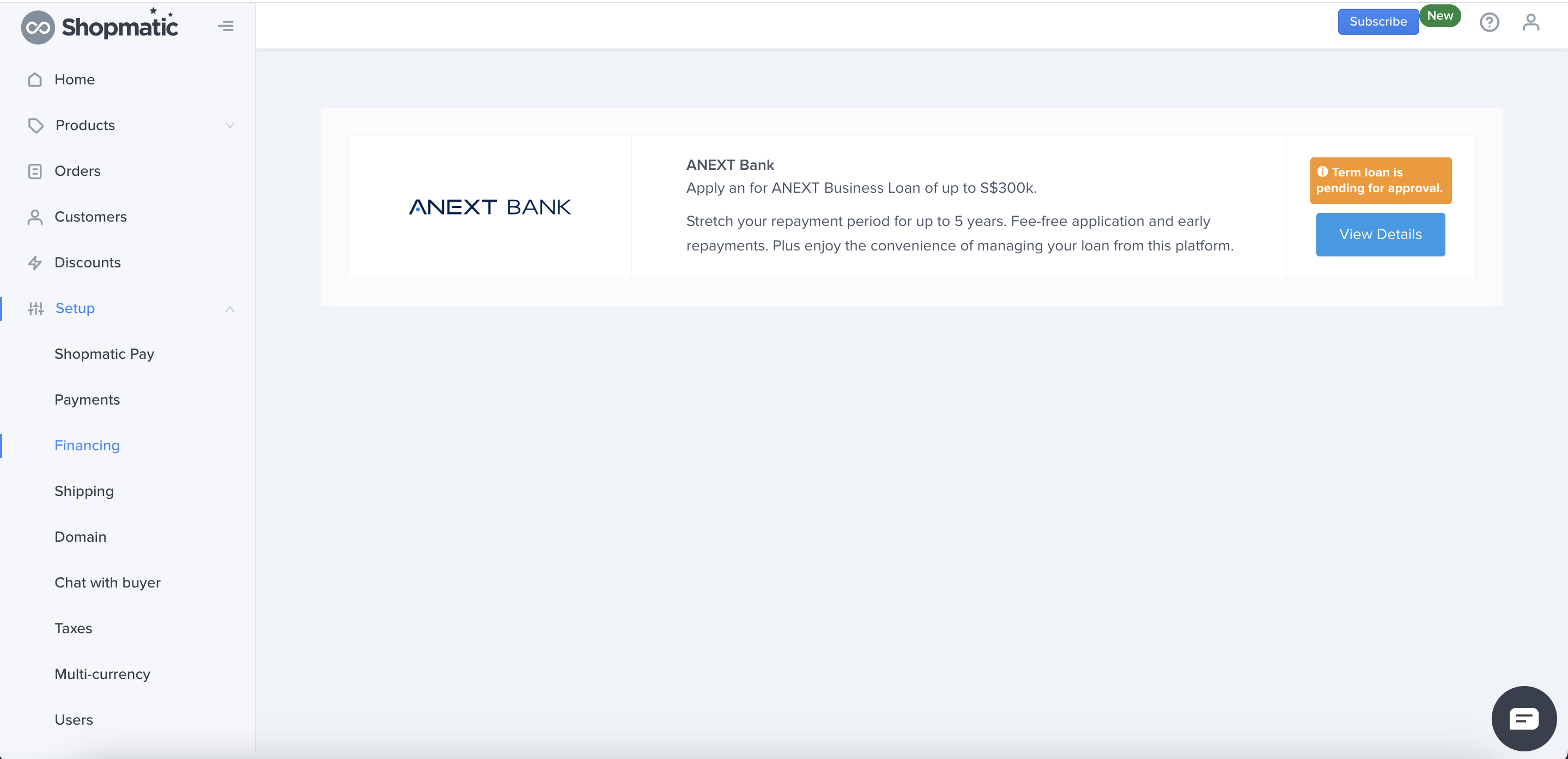

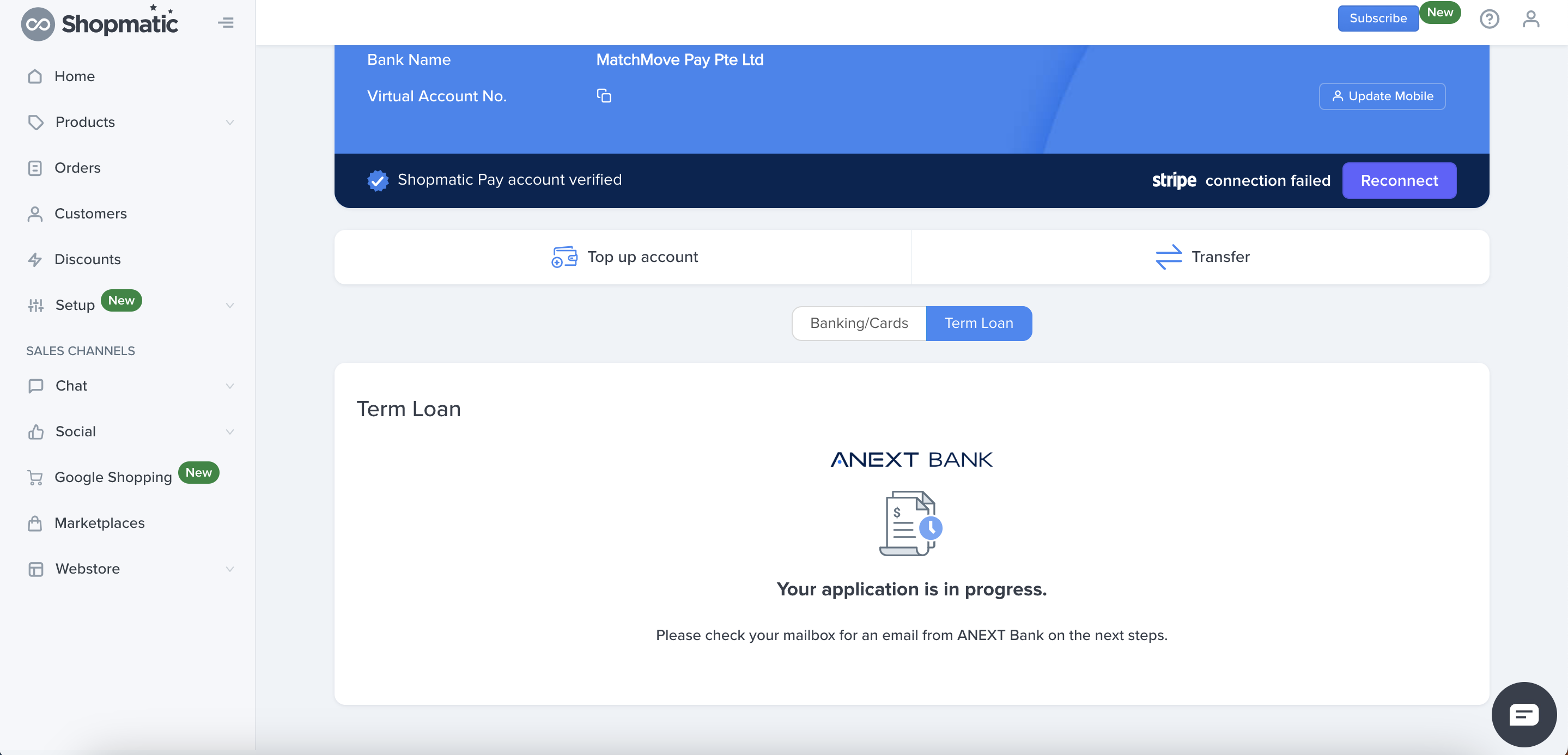

Once you submit the loan application, the ANEXT team will take 7-10 working days to process your loan application.

How do I see my loan application status?

On the Financing Page, simply click the “View details” button. Or you can see the application status on the Shopmatic Pay page, under the Term Loan tab.

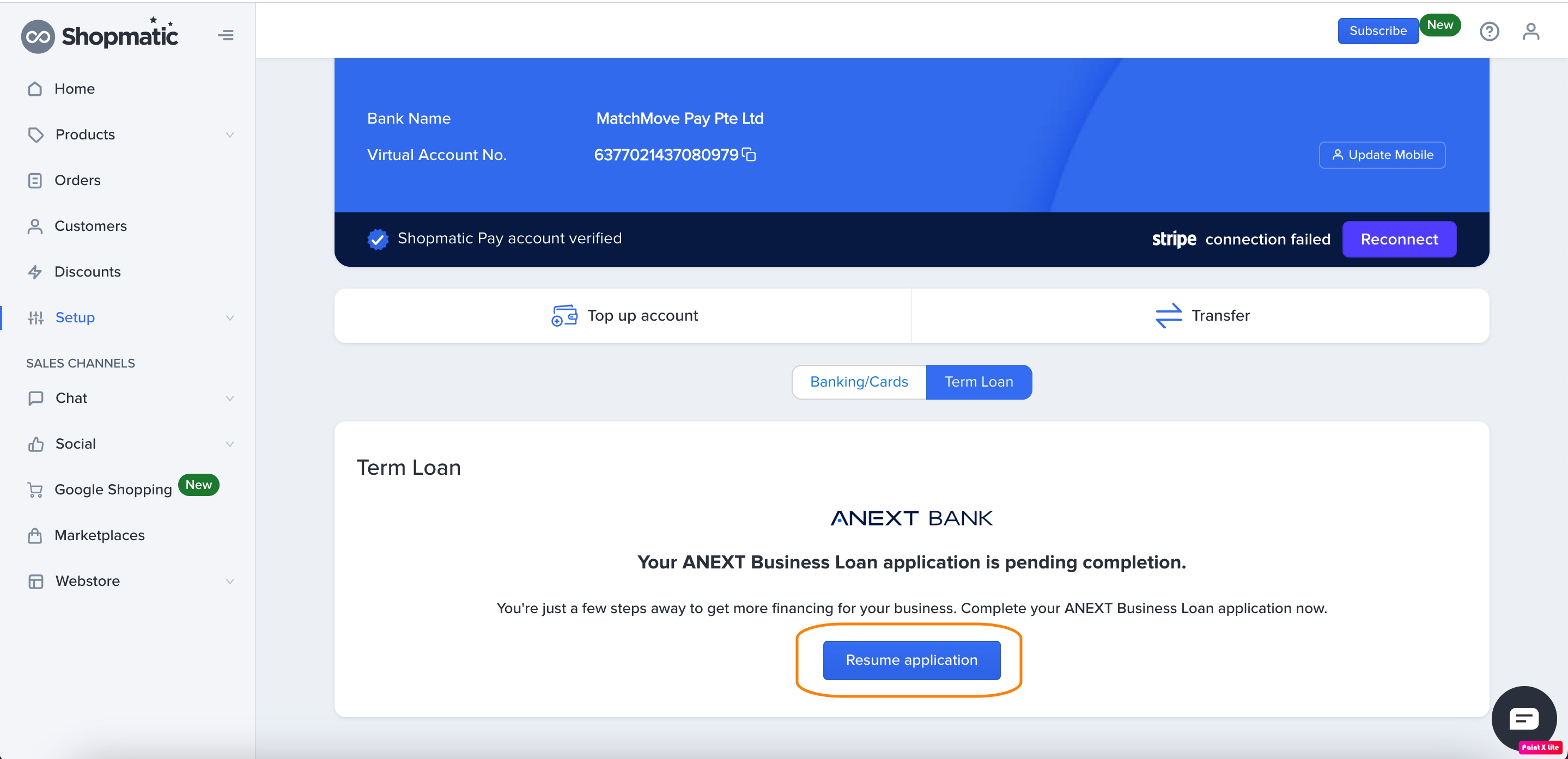

What are the term loan application stages?

Your loan application will progress through various stages, and the status will be updated accordingly. You can monitor the status of your loan application on the Shopmatic Pay page, under the Term Loan tab.

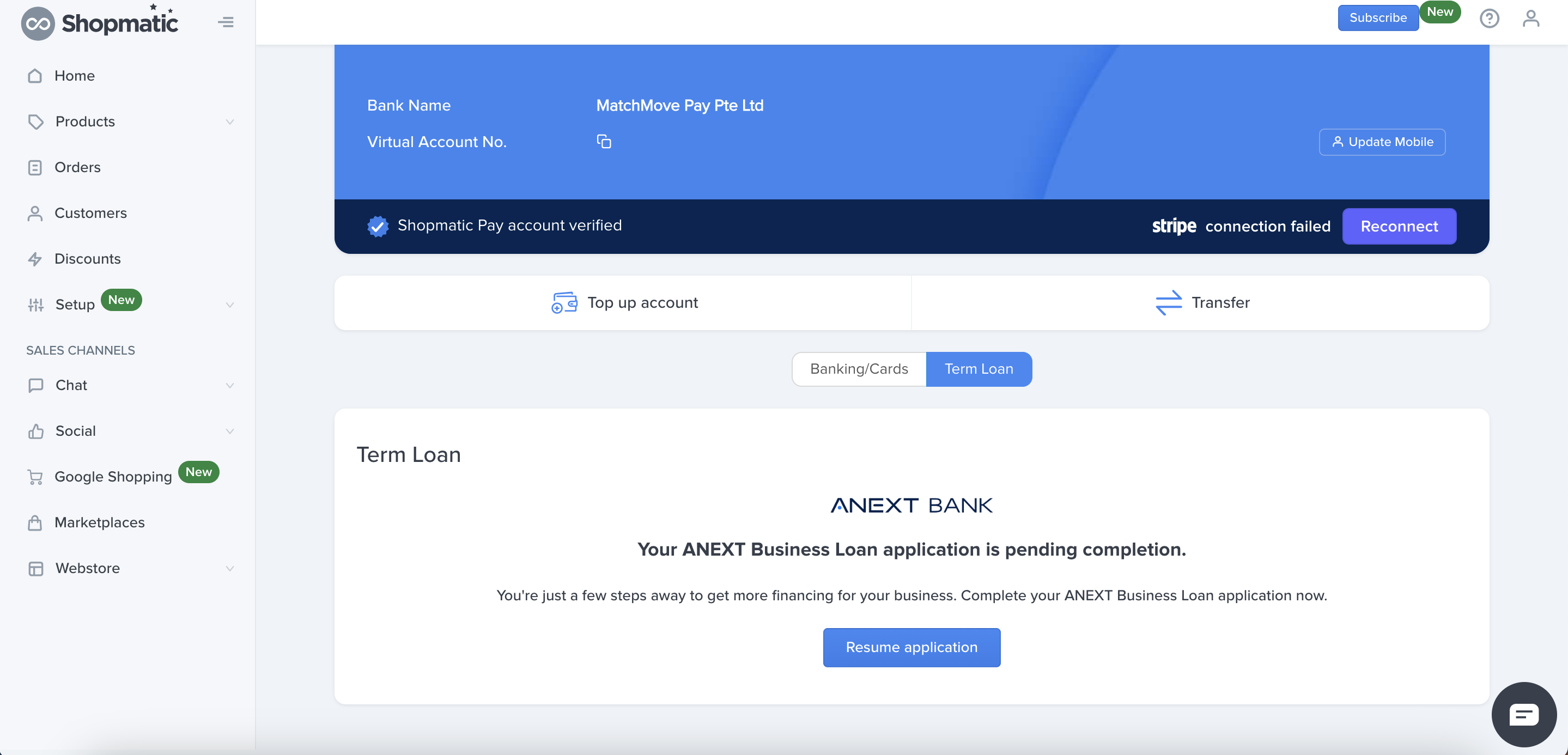

The loan application is Pending completion: If you discontinue the submission process for the term loan application, the status displayed on Shopmatic Pay under the Term Loan tab will reflect this.

The loan application is submitted successfully: Once you submit the term loan application, you will get this status.

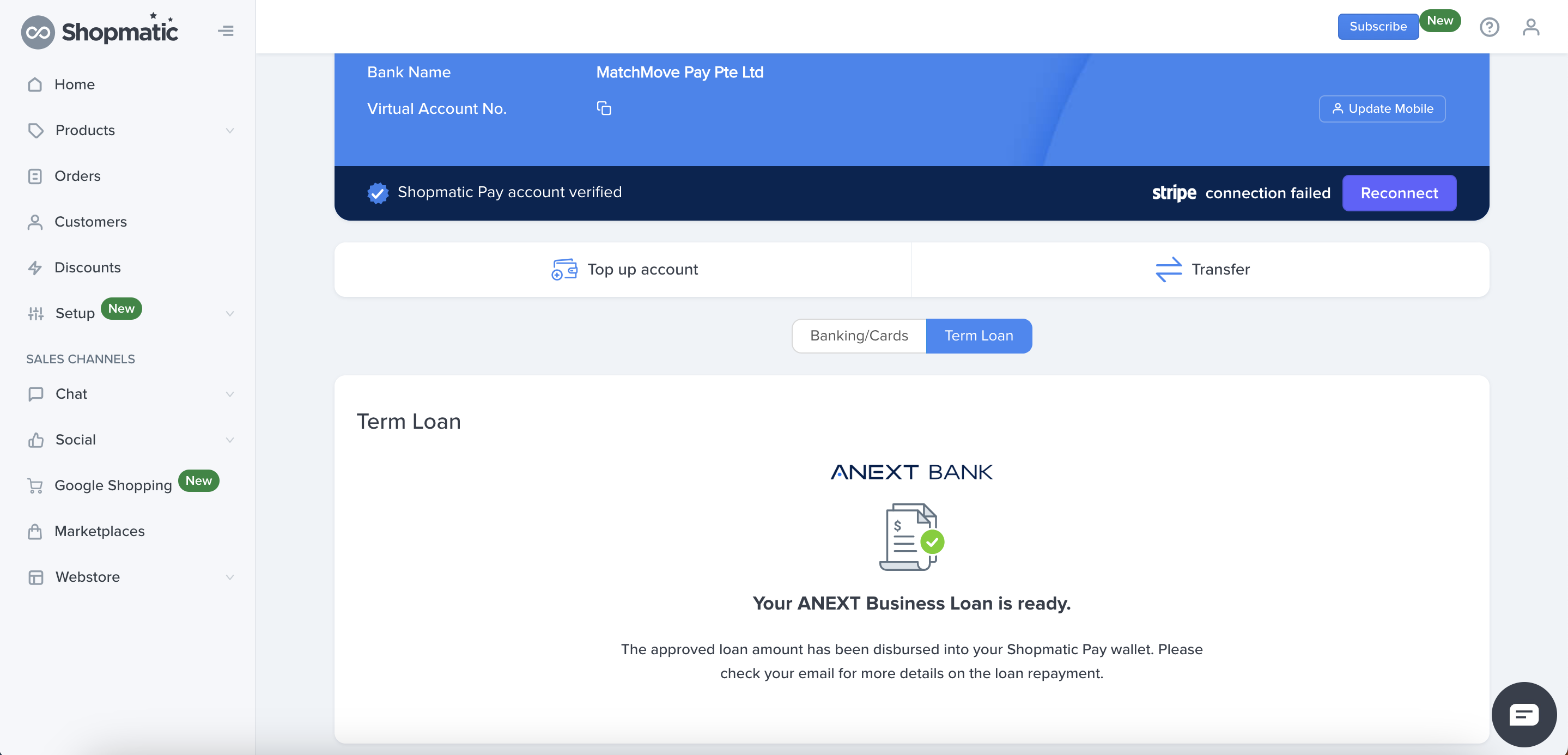

The loan is ready: This will be displayed once your Bank approves your term loan and you also accept the loan via email and SMS.

Where will the loan amount be disbursed?

Once you accept the Term loan approved by ANEXT Bank, you’ll receive the funds in your Shopmatic Pay Virtual account*.

Note:

* If your loan amount is less than or equal to S$5000, the amount will be credited to your Shopmatic Pay virtual account.

If the loan amount is more than S$5000, the amount will remain in your Anext Business loan account from which you can transfer it to your own account as you wish.

What will be the charges when the loan gets disbursed to my Shopmatic Pay account?

In the promotion period, there will be no processing fee, ANEXT will be waiving our processing fee for term loans secured through Shopmatic. So no other charges when the loan gets approved.

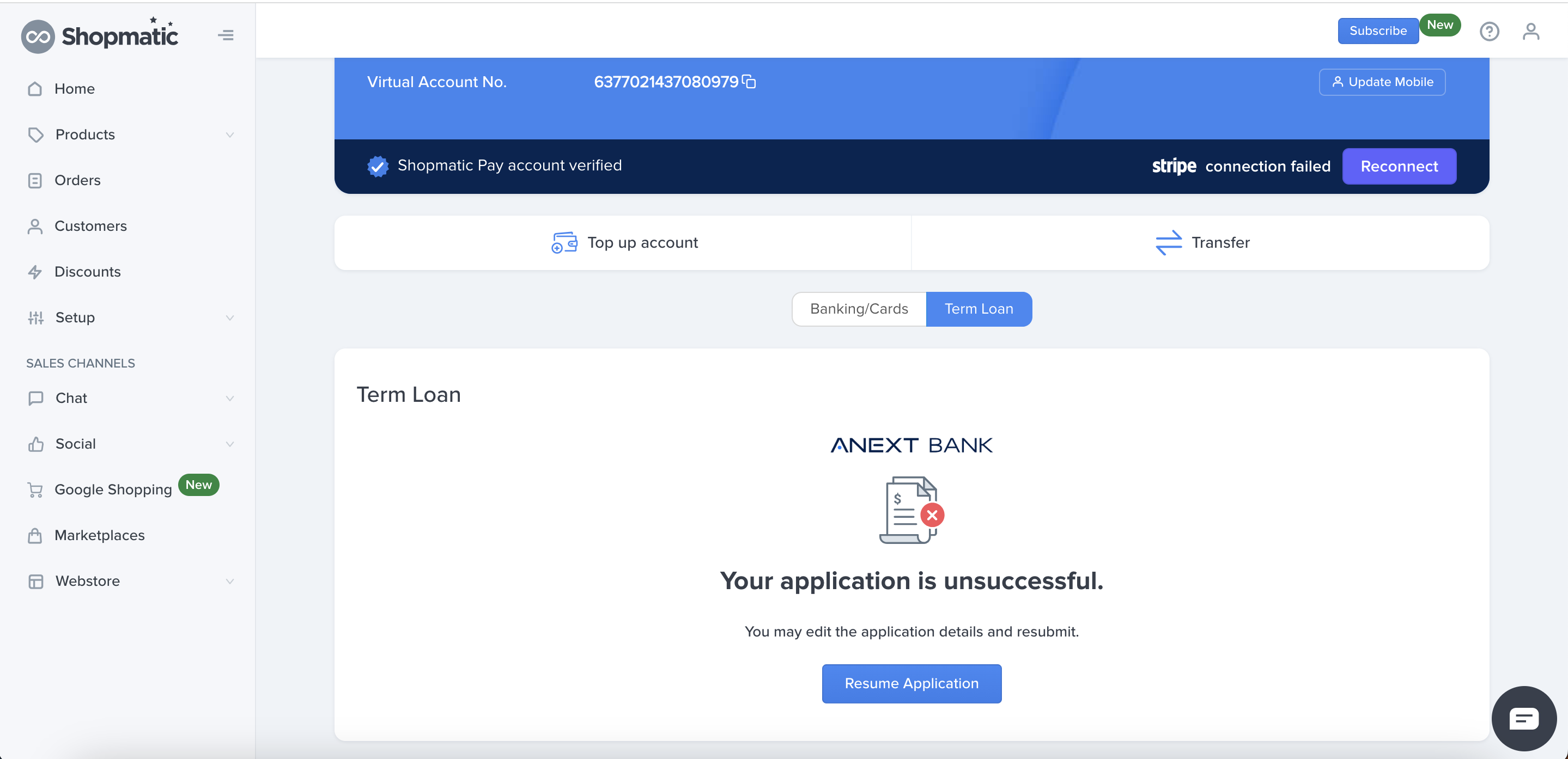

How and when can I apply for the term loan in case the application gets rejected?

If your loan application gets rejected, you can still apply for a term loan again by clicking the “Resume Application” button on the Shopmatic Pay Term loan tab. ANEXT team reserves the right to allow you to submit the loan application or not.

Can I get a term loan even if I have an existing loan with ANEXT Bank?

You can apply for a term loan from the Shopmatic platform. However, approval of the loan completely depends on the ANEXT team’s discretion. ANEXT team reserves all rights to grant a new loan or not.

Is it possible to submit a new application for a term loan immediately after the previous application has been rejected?

You have the option to submit a new application for a term loan, ANEXT team reserves all rights to accept or reject the loan application. (The usual cool-off period for loan re-application is 30 days)

What if I drop off in between and wish to continue my loan application?

You have the option to continue the application process, and you will be directed back to the page where you previously left off.

Due to some reason, if I cannot complete my loan application submission, can I resume the loan application submission?

Yes, you can. Simply click the “Resume Application” button on the Shopmatic Pay Term loan tab.

What will happen to my granted loan, if I fail to accept it via email and SMS?

If the loan is approved and you fail to verify the email & SMS sent by the ANEXT team in 14 days, the granted loan gets rejected.

What is the maximum number of concurrent loans I can have?

You can have only one active loan at any given time.

What happens to the loan if I close my Shopmatic account?

Shopmatic serves as a platform through which you can access ANEXT Bank’s loan services. The responsibility for repaying the loan remains solely between you and ANEXT Bank.

My Shopmatic Pay account is blocked, can I still apply for a term loan?

You have to unblock your Shopmatic Pay account before you apply for a term loan. We expect the Shopmatic Pay account to be verified before applying for a term loan.