Paytm is one of India’s leading payment gateways that offers comprehensive payment services for customers and merchants. Paytm offers mobile payment solutions to over 7 million merchants and allows consumers to make seamless mobile payments from Cards, Bank Accounts and Digital Credit among others.

IMPORTANT UPDATE: The Reserve Bank of India (RBI) has recently issued a directive impacting Paytm Payments Bank, which will affect any new deposits or credit transactions after March 15, 2024. As a result, if your Shopmatic webstore currently receives payments to your Paytm Payments bank account, we strongly advise updating your payment details to an alternative bank account on or before March 15, 2024.

As per the notice given by Paytm, failure to update your payment details will result in payments collected from your website not being credited to your Paytm Payments Bank account. However, it’s important to note that this directive does not affect the functionality of the Paytm gateway itself, and it will continue to seamlessly operate on your existing website to receive payments.

Accepting payments through Paytm on Shopmatic

When enabling Paytm for your online store you are establishing a relationship directly with them and are subject to their terms & conditions. All transaction fees & charges quoted are generated by Paytm and are payable directly to them. Any transactional and operational queries that happen on the Paytm platform should be referred to Paytm directly. Any queries about Paytm on the Shopmatic platform will be resolved by your dedicated Shopmatic Ecommerce Consultant.

Paytm preferential rates for Shopmatic merchants:

Merchants who create a new Paytm account through Shopmatic will enjoy these rates:

i) Setup Fee: Waived off!

ii) Maintenance Fee: Waived off!

iii) Credit Card: Visa, Mastercard @ 1.90% of the transactional value and American Express @ 2.75% of the transactional value

iv) Debit Card: Visa, MasterCard, Maestro @ 0.90% for transactions above Rs. 2000/- and 0.40% below Rs. 2000 as for Rupay Debit Card @ 0.00% of the transactional value

v) Paytm Wallet: 1.65% of the transactional value

vi) Paytm Postpaid: 1.80% of transactional value

vii) Net Banking: HDFC, ICICI @ 1.75%, other banks @ 1.55%

viii) UPI: 0.00% for transactions above Rs. 2000/- and 0.00% below Rs. 2000

How to enable Paytm:

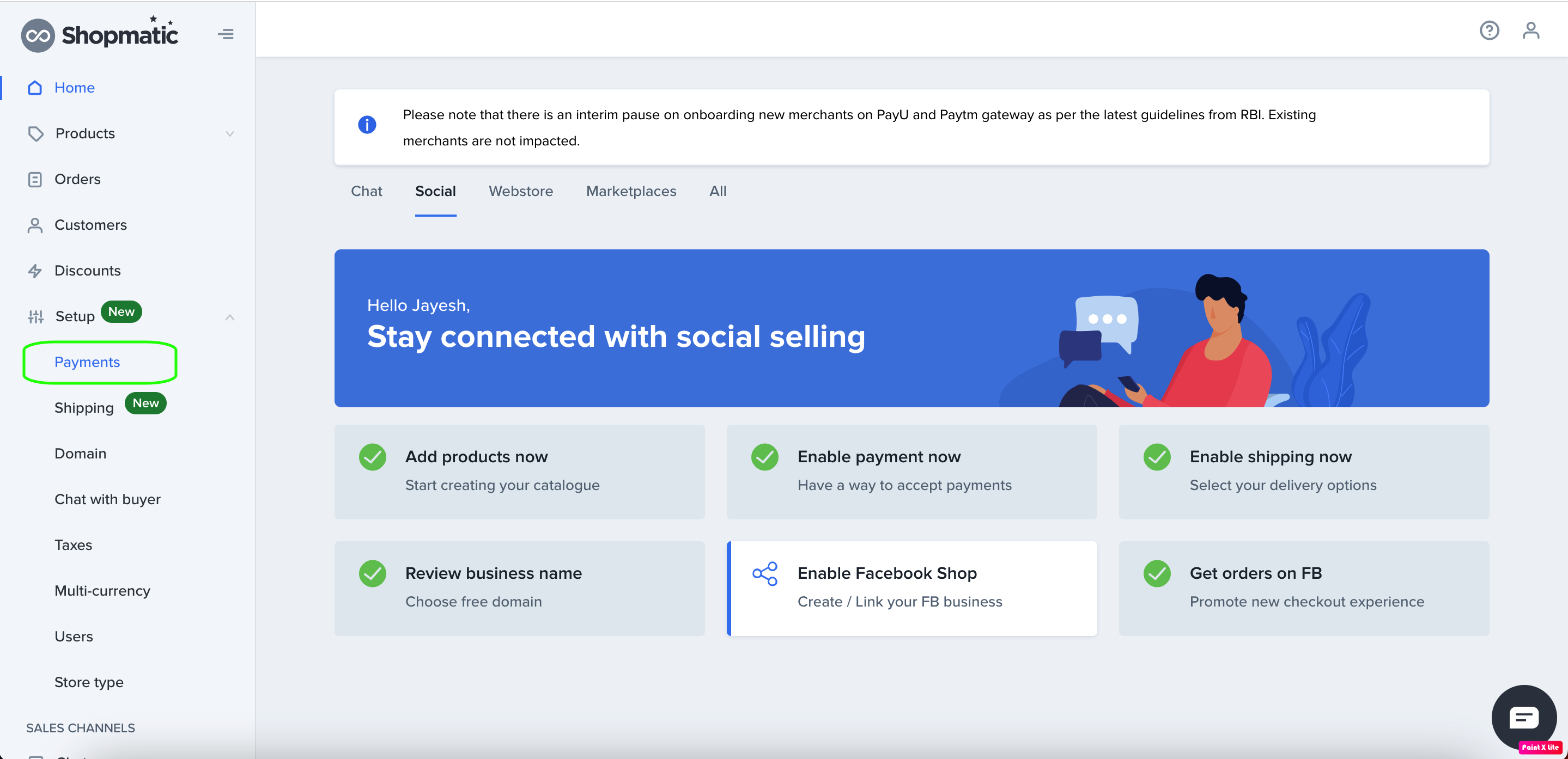

1. Login to your Shopmatic account, from the menu, click on Setup, and then on the Payments option.

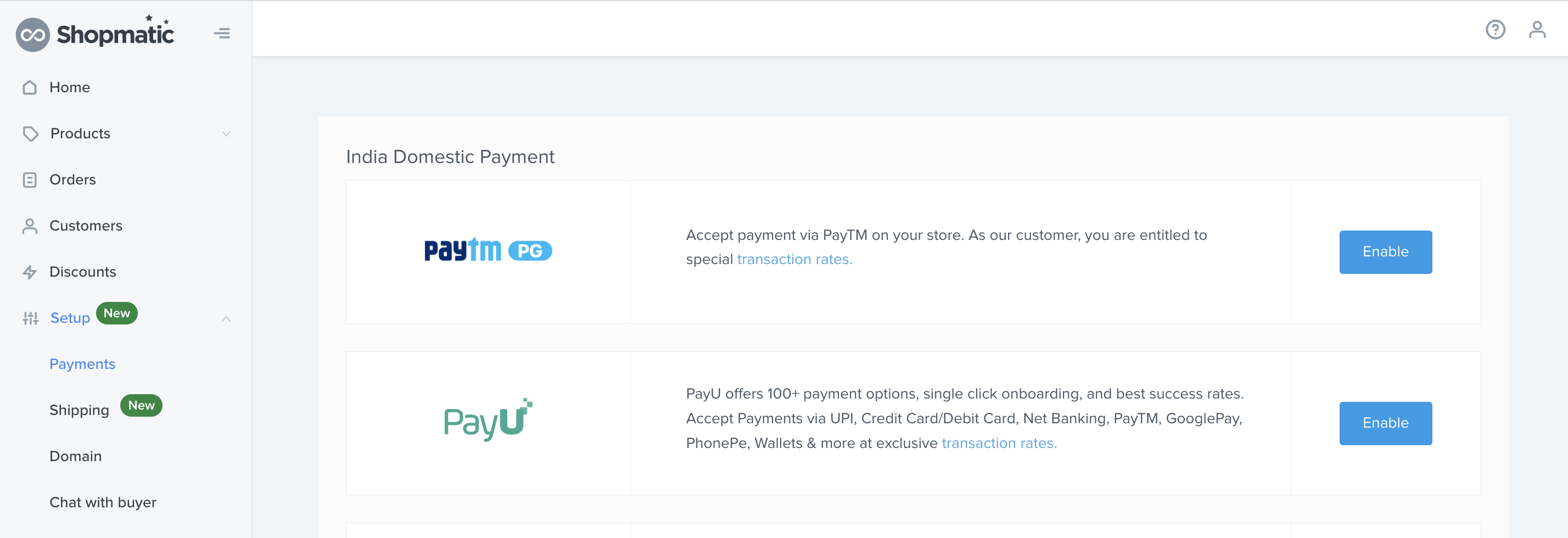

2. Click on the Enable button on the Paytm column

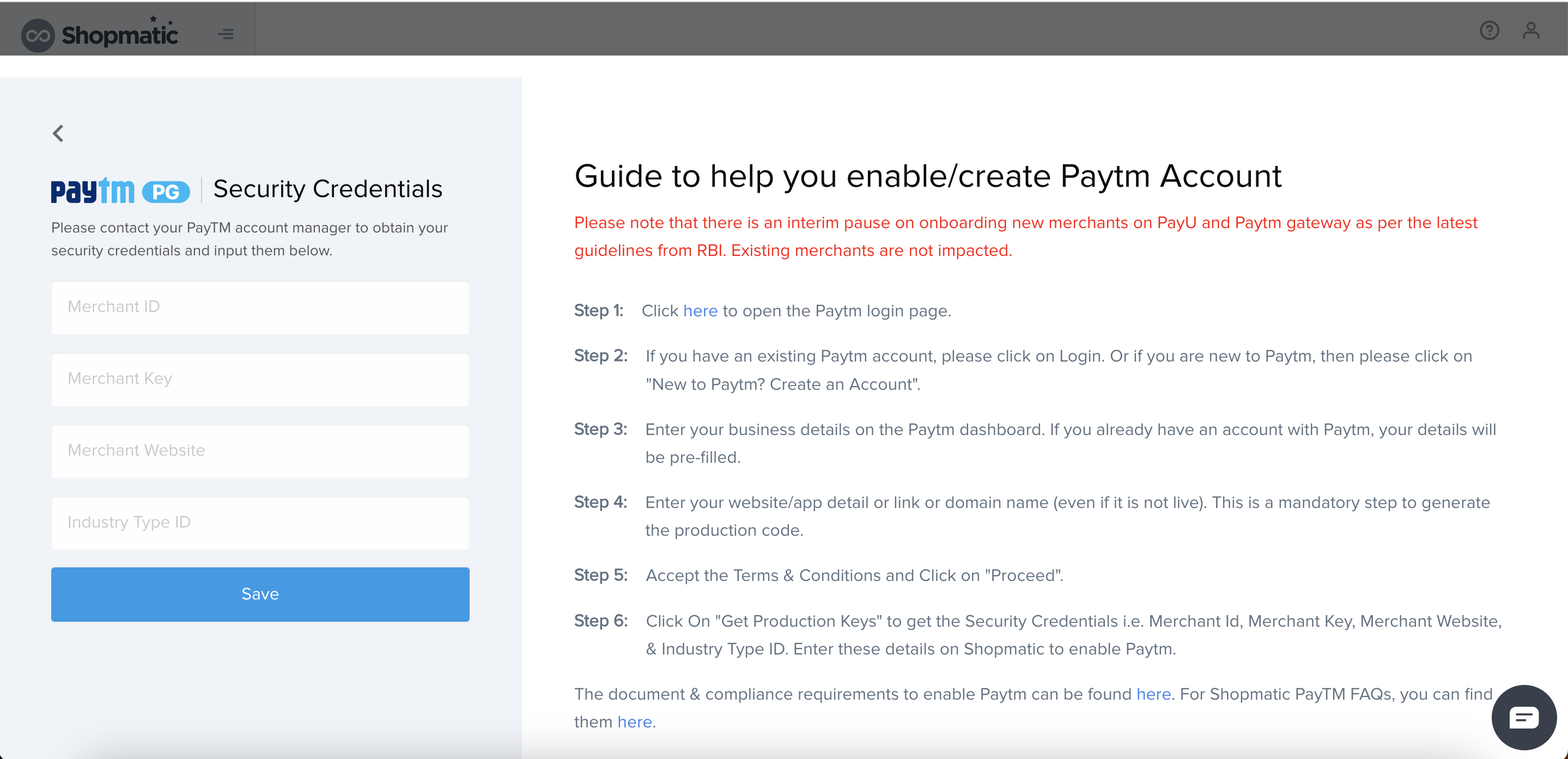

3. From here, please fill up Paytm’s form to obtain your Paytm Security Credentials

(Testing Credentials will not work, you must use Production API details)

Simply click on the Paytm Onboarding page link, and click on “New to Paytm? Create an Account”.

Once your account has been created, you will be provided with your Paytm Security Credentials by the Paytm team directly.

Once you have your Paytm security credentials, simply enter them on your Shopmatic platform (Merchant ID, Merchant Key, Merchant Website, Industry Type ID) and click on the Save button.

Additional Notes:

Paytm risk team will review websites/webstores to ensure completeness, these updates will be required for Paytm to fully activate the seller’s account:

- i. About Us page

- ii. Contact Us page (Company Name, Address, Contact numbers, Email IDs)

- iii. Product / Services details along with their pricing plans in INR

- iv. Privacy Policy (Click here to download generic Paytm template)

- v. Terms & Conditions (Click here to download generic Paytm template)

- vi. Return, Refund and Cancellation policy (Click here to download generic Paytm template)

- vii. Disclaimers

- viii. Shipping Policy (Only for shopping websites)

- ix. Payments and Logistics Partners information (only for shopping websites)

- x. Process flow to purchase the product & service – end to end

- xi. Declaration of the Authorised Signatory form (Click here to download generic Paytm template)

Once Paytm account is fully activated, the settlement period will be T+1.

For more details kindly refer to Paytm’s terms and conditions, which can be found on the Paytm seller homepage (https://seller.paytm.com/login).

Managing refunds from you the seller to your buyers

Refunds are reversal transactions wherein complete or partial money is moved back to the customer’s source account (the account from which the actual payment was made). Refunds can only be created for a successful or settled transaction.

Please visit Paytm’s support page to understand more about how you can execute a refund to your buyer. (https://developer.paytm.com/docs/refund-management/)